What is a Mobile Wallet?

Mobile Wallet, like Mobile Payments, is an overloaded phrase. It means different things to different people. For the sake of simplicity, let’s define the mobile wallet as an app or a set of apps that helps us to get rid of the physical wallet. That was a pretty slick definition, wasn’t it? To make the above definition a reality, what items should the mobile wallet hold? Let’s make a list.

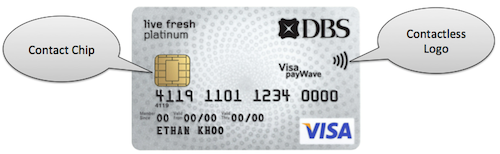

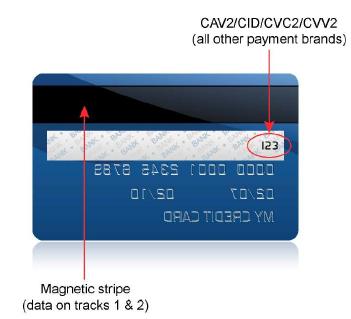

- Credit cards & Debit cards

- Gift Cards

- Loyalty Cards

- Driver’s License or any Identity proof

- Receipts

- Cash

- Business Cards

- Coupons, Offers

- Transit passes / tickets

- Movie tickets

- A mechanism to use all of the above everywhere

If a mobile wallet gives us all the above, then we can conveniently get rid of our fat physical wallets. We are not there yet, but sooner rather than later, we will get there. Today, many of the large tech and financial giants are focussing their efforts on the mobile payment side of things – Google and Paypal are good examples. Other giants are focussing on the non-financial aspect of wallets – Apple’s passbook comes to mind. As time passes, the industry will mature, concepts will merge, new innovations will take place, and before we know it we won’t be carrying our physical wallets anymore. Did we ever think that we will never wear a watch again, or never carry a point-and-shoot camera to our next pleasure trip?

Mobile Payments Blog Series

Welcome to the Mobile payments FAQ and not so FAQ series and you are on FAQ #11. The idea behind this series is to share and learn as much as possible about the field of mobile payments. If you like, you can read all of the FAQs on the Mobile Payments category or by visiting the Table of contents page.